By Shamillah Bankiya, Virginia Pozzato & Zoe Qin

Generative AI = Hype?

Today the majority of the tech community agrees that the fundamental technology behind Generative AI is transformational, and that applications based on large language models (LLMs) are set to change the world as we know it.

Generative AI companies are now making rapid advancements due to two major factors:

The first is that the speed at which businesses and users can create AI applications has been turned on its head. While it might have previously taken a team of 10 engineers years to stand up a particular AI-driven feature, today it can take one engineer a couple of weeks to deliver a production ready application thanks to APIs provided by LLMs.

The second is that the cost to quality ratio of outcomes has reduced dramatically. Previously, a business seeking to build a product based on hundreds of billions of parameters would have had to deploy hundreds of millions of dollars to get there (as market leaders like Open AI have done). The value of the size of these models is the end quality of outcomes — the more high quality information the model has, the more high quality outcomes you’ll achieve. The power of that quality is now available to all at low cost, and in the case of open source models, at zero cost.

Considering the current pace and breadth of innovation, it is unsurprising that Goldman Sachs estimates that Generative AI could raise global GDP by a full 7% — or almost $7 trillion. AI’s impact will be felt across the world and will span income scales: Goldman estimates that around two thirds of occupations could be partially automated by AI, while Open AI thinks this might be even higher, at 80% of jobs.

So, Generative AI may be a buzzword, but it is definitely not ‘hype’.

The major European Generative AI opportunity

The good news for Europe is that our continent is at the forefront of this Generative AI advancement.

Previous truly major technological shifts, such as the rise of cloud computing and of social media, were dominated by US-based companies. However, this time European innovators are at the heart and centre of the action and are set to compete and win globally, paving the way in building everything from market-leading foundation models to exciting B2B applications.

Many European startups have been quick off the mark too: Paris-based Hugging Face is now the world’s largest machine learning model hub. This achievement is no mean feat, and is a clear sign of Europe’s central role in the coming wave of Generative AI development and roll-out. Open source LLM Stability.ai, which started life at LMU Munich before relocating to the UK, is one of the leaders in text-to-image generation, Aleph Alpha, a Heidelberg-based startup is building an alternative large LLM, and Synthesia has just raised $90m to dominate synthetic video generation.

Additionally, European governments’ focus on privacy and GDPR compliance is likely to establish an important standard for the world in AI regulation. Most European companies and governments are thinking critically about how to make AI “ethical”, and over time these standards will structurally affect how applications are built in the space. In the long run, European Generative AI startups will benefit, with such standards being built into offerings from day one, providing a competitive advantage.

Where are the most exciting Generative AI B2B software opportunities emerging?

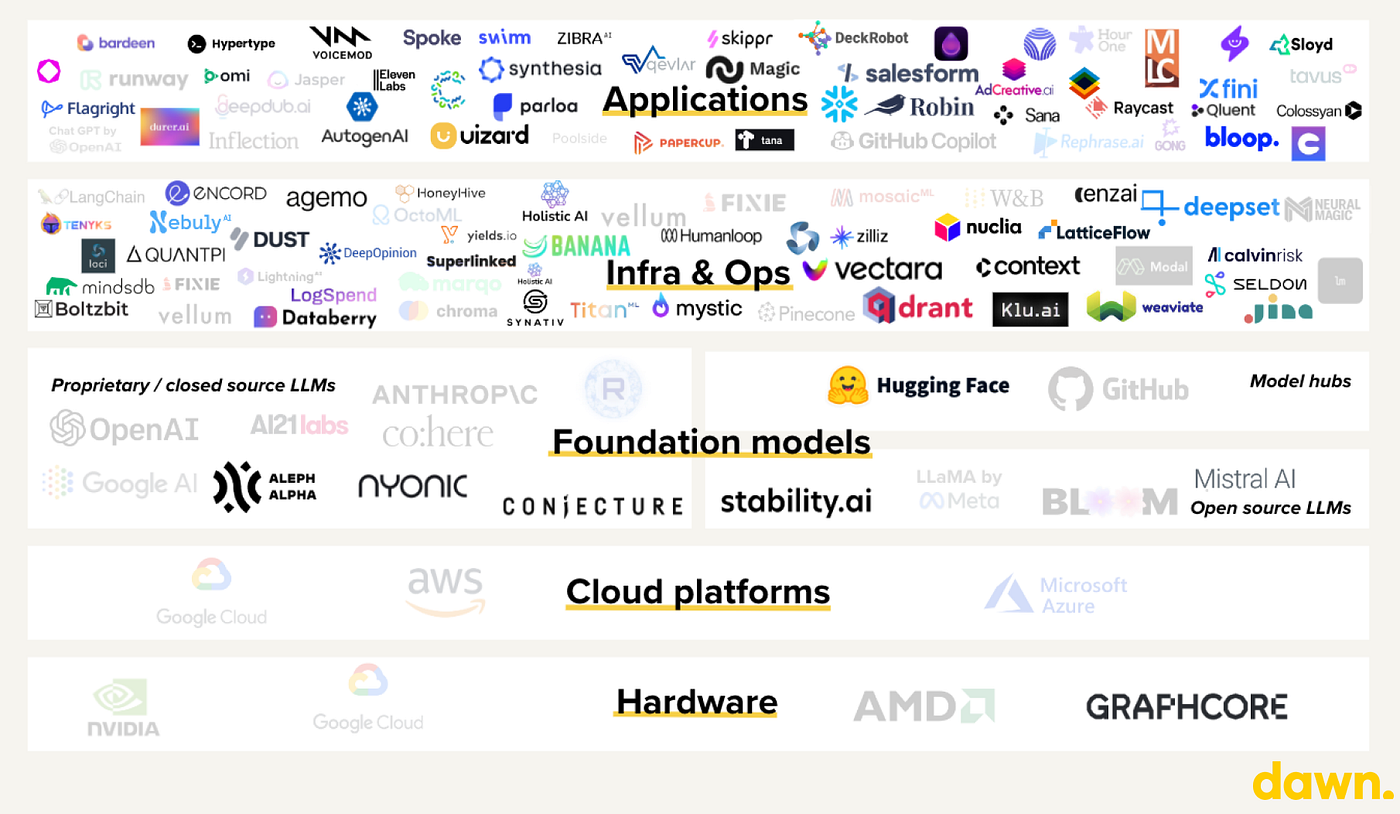

The graphic below outlines how we view the Generative AI stack today:

We see three core opportunity spaces across this stack, and in this section, we will introduce several European players already making waves.

Opportunity 1: B2B applications

The first major opportunity we see is at the application level: companies embedding generative AI into their products, serving a business user or consumer.

Here, large language models are being deployed to serve clear use cases in sizable addressable markets. We see three different types of approaches in the space:

- Use case specific applications: We’ve already placed an early bet here with Omi, a startup revolutionising the 3D digital content production process for e-commerce merchants. Another of our portfolio companies, Swimm recently launched an AI product that helps developers auto-generate code documentation structures. Other key examples of stand-out companies include Supernormal, who help organisations create meeting notes, and Raycast, who accelerate how quickly developers write code using ChaptGPT.

- Horizontal media applications: Alongside Synthesia, Colossyan and Hour One AI are leading the charge in synthetic video generation, while ElevenLabs, has become a clear front runner in text-to-speech generation.

- Vertical specific applications: Several entrepreneurs are also addressing verticals previously untouched by AI. In the life sciences space, for example, Corti is using voice-based AI to speed up medic-patient consultations and improve accuracy, and Cradle.bio is helping biologists to design proteins faster than ever before.

The cautionary note: We would add that it’s important to remember that these startups need to have tech with a clear moat, otherwise their offering is open to challenge from competitors and incumbents.

Opportunity 2: LLM Infrastructure & Ops

The second opportunity space that we’re actively exploring involves companies that are helping firms to build new Generative AI-driven products and features aimed primarily at builders and developers. These are core infrastructure businesses, and they’re our bread-and-butter here at Dawn.

We’re particularly interested in startups addressing key pain points in the space, including:

1. Limited model knowledge and ‘hallucinations’

LLMs such as GPT have memories constrained to the materials on which they were trained, and are restricted by how they react to prompts. This is a key pain point, and we are closely following enablers of semantic search capabilities, from vector databases to fully integrated solutions which resolve these constraints. We are also watching the development of in-database LLMs with AI tables. Some European innovators leading in this space are Nuclia, Deepset, Weaviate, Qdrant, and MindsDB.

2. Lack of access to the AI domain

Although accessing the AI domain is much easier today than it was back in 2015, the building, training, fine-tuning, deployment and management of this revolutionary technology can be better democratised. We’re tracking multiple exciting startups making inroads in this field, including Humanloop, dust.tt, klu.ai, and Qevlar.

3. Long and costly LLM inference

LLMs are large and their inferences take time, which creates high processing needs and high costs for businesses. Companies downstream are struggling to manage this, and we’re excited by innovators including TitanML and Nebuly, which are offering new turnkey solutions to resolve these issues.

4. Learning curve on AI governance

There is already an abundance of scoring available to assess the intelligence level of a new LLM. However, due to the inherent lack of explainability in LLM, there is no easy way to monitor and govern models. We’re keen to learn how startups are tackling these challenges, and have been impressed by the efforts of Holistic AI, Context (formerly Woolly.ai) and Enzai.

The cautionary note: LLM Ops & Infrastructure use cases are emerging, but the market is still dominated by open-source projects, and monetisation is driven by managed cloud solutions. We are still in the early innings of what effective monetisation will look like for these businesses.

Opportunity 3: Foundation models

- We’re also extremely excited about foundation models and the opportunity they present.

- These models form a critical part of the Generative AI tech stack — at the end of the day, the magic really happens at the foundation level. The ‘right approach’ to take when it comes to foundation models is still up for debate, with arguments for large vs small focused models, and a closed vs open source approach.

- European leaders here are placing an emphasis on the reliability and trustworthiness of the models and pipelines around, especially catering to closed loop enterprises sensitive to data leakage. Aleph Alpha and Mistral.ai, both received fresh funding this year to take on this very expensive challenge with exceptional founding teams.

The cautionary note: These models are capital intensive, and have proven hard to monetise despite being embedded in many applications. This is often because they self-learn on the internet, meaning all their data is publicly available.

We’re hugely excited by the inroads being made by European Generative AI companies. Global champions of tomorrow are being born on our doorstep, and we’re here to support the teams behind these companies as they work to shape the future.

If you’re a founder innovating in this space, please get in touch at shamillah@dawncapital.com, zoe@dawncapital.com and virginia@dawncapital.com.