An excel hangover and a serious headache

There was a time, not so long ago, when most of the small business world lived offline. Physical premises and a phone line sufficed for most mom-and-pop shops and small corporates to function. The last thirty years, however, have seen radical change. With the advent of the digital revolution, most of the world had to move with the times to survive. It has become commonplace to say that every business is now a technology business. Today, even the most analogue shops have a payments and accounting system, albeit typically outdated. Many have a basic landing page or are at the very least contactable by email. Small corporates are turning to technology to handle functions such as HR and marketing. One glaring gap remains―expense management.

Many might find it surprising that business expenses are yet to be tackled. Once rent, salaries and inventory costs (if any) have been paid, the remaining cost base, frequently a substantial part of the total cost of running a business, is typically accumulated by staff. Travel, office supplies, printing, entertainment and replacing broken equipment all need to be paid and accounted for. And yet, when it comes to these expenses, businesses revert back to manual processes: a couple of corporate credit cards, paper receipts and old fashioned expense reports, or even typing up of the items bought. The inconvenience to every party involved is hard to miss.

So why has this problem not yet been solved? The simple answer is “because it is so complex.’’ Expense management involves multiple stakeholders with conflicting needs and finds itself at the epicentre of many business processes to be integrated or complied with. The employer cares about the bottom line: every expense should be reasonable and trust is a thorny subject when it comes to managing people. Encouraging the autonomy to grow sales while keeping tight control of the ship is an added complexity. The employee, on the other hand, is all about convenience. Fronting your own cash for a business you don’t own is a pain, saving up receipts is a bore and waiting for your boss’ card is hugely inefficient. And as if this dichotomy was not enough, the finance director is added to the equation. In their world, accountability is the name of the game, tying together bookkeeping, real-time cash management, VAT extraction and, alas, audit. The task is gigantic as the finance function deals with multiple business systems, frequently having to bridge the gaps between them with manual work. In short, “I love doing expenses”―said no one ever.

We are sold on Soldo: the new standard in spend management

With the complexities of spend management in mind, it is no wonder that until today, no one has cracked the market. Some enterprise-focused solutions exist, but these are large, monolithic players that cannot adapt to the day-to-day realities of smaller businesses. And even large clients struggle with the UX of these solutions. Some other solutions, though adapted to a smaller scale, have only targeted one variable in the expense management equation: they are either employee-only mobile apps not linked to any useful business systems or glorified accounting tools with a marginally nicer UX. Enter Soldo. We believe that we have finally found the company capable of winning this market. We are proud to be co-leading Soldo’s $61m Series B together with our friends at Battery, and alongside existing investors, Accel and Connect Ventures. For Dawn, this is the largest ever first investment in a fintech business.

Soldo is redefining the business spend category from scratch, putting trust, ease and compliance at its core. Its sleek and fully automated solution replaces manual processes and is deeply integrated at the heart of all business systems. Soldo’s secret sauce is that it does not compromise on any parts of the business expense equation.

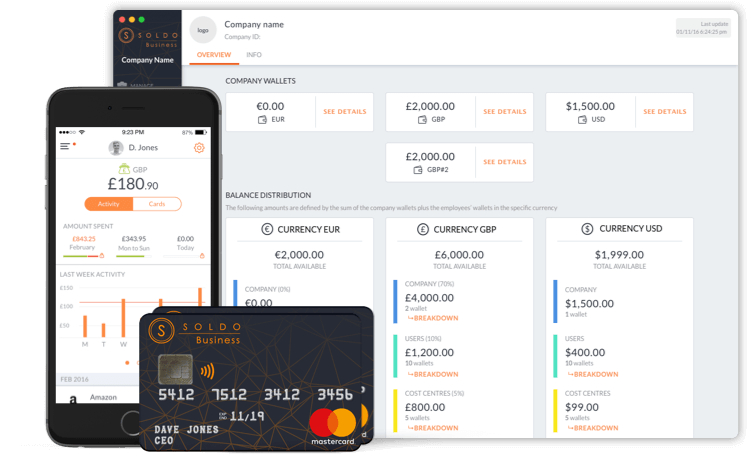

Employees swap out-of-pocket expenses for a pre-paid and easy to use product. They are given a pre-paid MasterCard™ in the currency of their choice and are free to make purchases within authorised limits. Should the purchase be made online, a virtual card can be generated on the go. Once the purchase is made, all that is required is a quick photo of the receipt―Soldo’s OCR technology will extract the relevant data and ask you which project or code the expense should be claimed against. No need to save the paper receipts or log onto a web portal to triage and tag.

Employers, on the other hand, regain control, without compromising on staff productivity. Managers can set spending limits and specific rules and guidelines that apply to individuals or the entire team. Should deviation be necessary, employees can ask for a specific expense to be accepted and the request will be routed to the manager in-app for immediate response. Having made their purchases with ease, teams can focus on what they do best―their job, while managers remain in the loop at all times via live dashboards and the app.

Equally, the finance function has not been left behind and gets complete visibility and a fully automated solution. Expenses can be loaded into the accounting system directly, matching the charter of accounts and specific project codes. Integration is seamless and happens at the press of a button. Tracking can be done live, allowing for real-time cash management. Importantly, this all comes at a fraction of the cost of a traditional corporate card and with a suite of additional bells and whistles.

Soldo has every base covered and this is why we feel the team has cracked it. Their solution solves the pain points of every stakeholder and at no one’s expense.

Conquering Europe

Today, Soldo is already present in the UK, Italy and Ireland. The opportunity in these markets alone is huge: over 3 million businesses are in Soldo’s sweet spot. But the goal is, of course, pan European domination: there are 5 million more targets in the next two countries on Soldo’s roadmap and a total of 20 million across Europe, a multi-billion dollar market that continues to grow.

Founded in 2014, Soldo has started chipping away at this gigantic opportunity. The business boasts 40,000 clients and has demonstrated rocketship growth in 2018, seeing a 500% uplift in run-rate revenue during the year. Soldo’s rapid growth is paired with a uniquely high margin, akin to that of a SaaS business (note: Soldo’s revenues comprise monthly subscription revenue and transactional revenue based on volume of expenses)―Soldo is the only player in the market with e-money licenses in both the UK and Europe, allowing it to command superior economics and effective “Brexit-proofing.”

All of this has been made possible by Soldo’s team of over 100 experts, from tech veterans to payment pioneers. Its founder and CEO is Carlo Gualandri, an Italian technology entrepreneur whose innovative companies have broken new ground in the world of media (Virgilio), banking (Fineco), and gaming (Gioco Digitale). But Carlo is not alone on his mission to shape the future of expenses. Carlo has reassembled the technology veterans from his previous ventures, like Carlo d’Acunto, ex CTO of Gioco Digitale who helped shape the early days of the Internet. Carlo has also brought in fresh blood from other highly successful businesses: Stuart Gammon and Rob Norman have joined Soldo from Box, while Darren Upson hails from Xero, one of Soldo’s accounting partners. Last but not least, Mariano Dima, ex-CMO of Visa Europe, is joining Soldo as a Board member and advisor, completing the line-up of international expertise.

We are excited to be bringing a decade of fintech investing to the table, with Soldo joining the ranks of iZettle, Divido, Sonovate and OpenGamma in our portfolio. In fact, Soldo has a number of parallels to the journey we saw with iZettle, from its early venture stages all the way to the $2.2bn cash sale to PayPal. It is a long journey and we are excited that this is the biggest round to date for a spend management fintech―this is the fuel we need to conquer Europe and beyond.